SSP Briefs

Estate Planning

Sharing Your AI Voice With Loved Ones in Your Estate Plan

Elder Law

Scam Email Targets Social Security Recipients

Estate Planning

Congress Considering Full Repeal of Estate Tax

Special Needs Planning

Passing Retirement Benefits to a Child With Special Needs

Elder Law

2024 Survey Shows Long-Term Care Costs Continue to Rise

Estate Planning

When, Why, and How to Talk About End-of-Life Care

Estate Planning

Transfer-On-Death Accounts: A Useful Estate Planning Tool

Estate Planning

Estate Planning in the Face of Natural Disasters

Estate Planning

Love Your Pet Day: Estate Planning and Your Companion Animal

Estate Planning

Estate Planning for a Vacation Home

Estate Planning

The Great Wealth Transfer: Managing Your Inheritance Wisely

Special Needs Planning

I Don’t Need SSI or Medicaid. Why Get a Special Needs Trust?

Elder Law

How to Apply for Social Security Retirement Benefits

Elder Law

Hoarding Disorder in Older Adults: Challenges and Resources

Estate Planning

Who Holds Your Will and Other Estate Planning Documents?

Special Needs Planning

Voting Rights for People With Disabilities

Estate Planning

Who Needs a Trust Instead of a Will?

Elder Law

Voting Rights for People With Cognitive Impairment

Elder Law

Does Medicare Cover Hearing Aids?

Estate Planning

Funeral Arrangements: How to Make Your Wishes Known

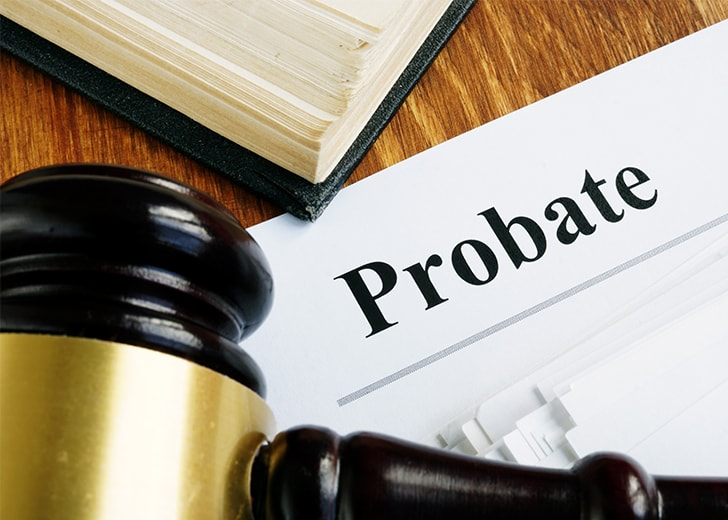

Probate

Proper Estate Planning Reduces Issues of Probate

Estate Planning

IRS Finalizes 10-Year RMD Rules for Inherited IRAs

Special Needs Planning

Financial Help for Parents of Children With Special Needs

Special Needs Planning

SSA Names 9 New Compassionate Allowance Conditions in 2024

Elder Law

The Loneliness Epidemic: Helping Seniors Stay Connected

Elder Law

my Social Security Transitions to Login.gov

Elder Law

11 Reasons You Need to Create an Estate Plan

Business Law

Estate Planning for Entrepreneurs and Business Owners

Estate Planning

7 Common Inheritance Mistakes to Avoid

Estate Planning

Avoid Guardianship With a Durable Power of Attorney

Special Needs Planning

Does a Personal Injury Settlement Affect Disability Claims?

Special Needs Planning

Will My Disability Benefits Change When I Turn 65?

Elder Law

Proposed Medicare Bill to Help Seniors With Medical Costs

Estate Planning

Why Trusts Are Important Estate Planning Tools

Estate Planning

Blended Families and Wills in Estate Planning

Special Needs Planning

Impairment-Related Work Expenses and Disability Benefits

Special Needs Planning

More People to Qualify for SSI Under New Rental Subsidy Rule

Elder Law

HUD Housing Programs That Support Aging in Place

Elder Law

Does Divorce Affect Social Security Spousal Benefits?

Estate Planning

7 Things to Know About Living Wills

Probate

Probate Process: A General Timeline

Estate Planning

High School Graduation: A Good Time for Financial Planning

Special Needs Planning

How Are Benefits for Disability (SSDI) Calculated?

Special Needs Planning

Independent Living for People With Disabilities

Elder Law

Elder Financial Abuse: How an Elder Law Attorney Can Help

Elder Law

What You Should Know About Long-Term Care

Estate Planning

What Is the Difference Between a Will and a Trust?

Estate Planning

What You Should Know About Prepaid Funeral Plans

Estate Planning

How to Get a Death Certificate After a Loved One Dies

Estate Planning

Be Aware of the Dangers of Joint Accounts

Special Needs Planning

Supplemental vs. Special Needs Trusts: Any Difference?

Elder Law

Avoiding Property Tax Foreclosures for Older Adults

Special Needs Planning

Will I Lose My Disability if I Work Part-Time?

Special Needs Planning

Food Will No Longer Count as Income for SSI Recipients

Estate Planning

Securely Storing Your Legal Documents

Elder Law

Good News for Medicare Advantage, Medicaid Patients in 2026

Elder Law

Survey Highlights High Costs of Long-Term Care in 2023

Elder Law

Social Security Announces Four Key Updates to Address Improper Payments

Estate Planning

40% of People Say They Don’t Have Enough to Make a Will

Probate

Who Does a Probate Attorney Represent: Executor or Heirs?

Special Needs Planning

Home Ownership for People With Disabilities

Estate Planning

Getting Help When Providing Care at Home for Aging Parents

Elder Law

Medicaid Spend Down: Pay for More Than Just Medical Bills

Elder Law

Are You a Family Caregiver? New Bill Seeks to Lower Costs

Special Needs Planning

Lifetime Money Management for Children With Disabilities

Estate Planning

A Seniors Guide to Estate Planning

Business Law

Corporate Transparency Act Reporting Has Begun

Business Law

CTA Imposes New Small Business Reporting Requirements for 2024

Elder Law

What Are the Different Types of Adult Day Care?

Elder Law

2024 Standard Protections for Spouses of Medicaid Applicants

Special Needs Planning

Choosing Trustees for Special Needs Trusts: 5 Considerations

Estate Planning

New Year’s Resolution: Get That Estate Plan Done

Estate Planning

Baby Boomers: Inheritance Conversations With Your Children

Elder Law

Is an Independent Living Facility Right for Me?

Elder Law

PACE Program Helps Seniors Remain at Home

Estate Planning

14 Essential Questions to Ask Aging Parents This Holiday

Estate Planning

Should My End-of-Life Care Plan Include a Death Doula?

Special Needs Planning

Five Reasons to Contact a Special Needs Planner

Estate Planning

Is Your Financial Information in Order?

Probate

Reducing the Risk of a Family Fight in Probate Court

Estate Planning

Estate Planning for Surviving Spouses

Estate Planning

8 Frequently Asked Questions on Last Wills and Testaments

Estate Planning

What Are the Drawbacks of Naming Beneficiaries?

Elder Law

Innovative Long-Term Care Housing Solutions for Seniors

Elder Law

Home Health Services Underutilized by Seniors, Study Shows

Estate Planning

Protect Your Home from Fraudulent Transfers

Business Law

The Impact of Corporate Transparency Act on Your Business

Estate Planning

Estate Planning for Your College-Aged Student

Estate Planning

What is a Postnuptial Agreement?

Estate Planning

Going through a Divorce? Don’t Neglect Updating Your Estate Planning

Business Law

FTC PROPOSES TO OUTLAW NON-COMPETE AGREEMENTS

Estate Planning

Major Changes in IRA and 401k Distribution Rules

Power of Attorney

THE NEW DISTRIBUTION RULES UNDER THE “SECURE ACT”

Estate Planning

Start to Plan Your Estate in 4 Steps

Estate Planning

Should You Set Up An Irrevocable Trust?

Estate Planning

All About Transfer on Death Deeds: Your Questions Answered

Estate Planning

Your Guide to Irrevocable Trusts: Disadvantages and Advantages

Estate Planning

How Estate Planning Can Protect Your Assets

Power of Attorney

Understanding the Types of Power of Attorney

Estate Planning

Your Guide to Setting Up a Charitable Trust

Estate Planning

Why Estate Planning is Important

Elder Law

Common Medicaid Pitfalls and How to Avoid Them

Estate Planning

Primary Beneficiary vs. Contingent Beneficiary: What’s the Difference?

Estate Planning

Guardianship vs. Custody – What Are Your Legal Rights?

Elder Law

Wondering How to Apply for Medicaid?

LGBTQ+ Issues

3 Considerations When Estate Planning for LGBT Couples

Estate Planning

Second Marriages

Special Needs Planning

Advocating for your SN child

Elder Law

The Sandwich Generation

Probate

How Does Probate Work in Ohio?

Estate Planning

Do you want your child’s spouse to inherit your money?

Estate Planning

Time on Your Hands? Update Your Estate Plans

Estate Planning

Estate Planning vs. Medicaid Planning

Estate Planning

What are the most important benefits of trusts?

Estate Planning

Here are 3 ways that you can prevent a will contest

Estate Planning

Do you need to have a will?

Probate

What are the benefits of avoiding probate?

Estate Planning

Spendthrift trusts could be a good answer for risky beneficiaries

Estate Planning

Get help with an estate plan: A will is not enough

Elder Law

How can you prepare for needing long-term care?

Estate Planning

How do you become a conservator in Ohio?

Probate

Some probate problems can be prevented with a family meeting

Estate Planning

Why set up a trust? Here are some good reasons

Estate Planning

Stop procrastinating, and get a will as soon as possible

Estate Planning

Are you responsible for your loved one’s debts after their death?

Estate Planning

Keep these 3 things in mind when choosing an executor

Estate Planning

Where to store estate planning documents

Estate Planning

What are 3 myths about wills I should know?

Estate Planning

Planning for long-term care can keep you in your home

Probate

What is probate and how can you avoid it?

Estate Planning

What makes a will legal and valid?

Estate Planning

Understand the importance of a conservatorship

Estate Planning

When is the right time for estate planning?

Elder Law

Ohio is failing our senior citizens

Elder Law

Start planning for your long-term care needs today

Estate Planning

Understand taxation, and how it affects an estate

Estate Planning

Learn more about what trusts are and how they benefit you

Estate Planning

Plan for injuries and conditions with an advance directive

Estate Planning

Debts and death: What you should plan for

Estate Planning

How to talk to your parents about estate planning

Elder Law

Make a plan for your long-term health care needs

Estate Planning

Get the help you need as a new executor

Estate Planning

What is the difference between a will and a living will?

Estate Planning

Plan for long-term care when young to prepare your finances

Estate Planning

Explaining who can see a will after a testator dies

Elder Law

Understanding Alzheimer’s: Key facts

Estate Planning

The importance of updating your estate planning materials

Elder Law

Long-term care can have a devastating financial impact

Estate Planning

How does a judge decide whether to set up a guardianship?

Probate

How can I avoid probate in Ohio?

Estate Planning

Why you should think about creating a will

Estate Planning

Long-term care planning: Housing options for seniors

Estate Planning

Picking a trustee

Estate Planning

Have you lost a relative who had no will or trust?

LGBTQ+ Issues

Will our LGBTQ+ elders face discrimination in nursing home care?

Estate Planning

Estate Planning Mistakes to Avoid

Estate Planning

How to create a digital estate plan

Probate

About the probate process

Estate Planning

Trusts can be amended to make changes

Estate Planning

Handling debt when a spouse passes

Estate Planning

How to pay for long-term care

Estate Planning

How to use a living trust to the fullest

Elder Law

The importance of care planning

Estate Planning

Blended families and estate plan disputes

Estate Planning

Estate planning can entail more than just a will

Estate Planning

DAPTs offer various estate planning benefits

Estate Planning

The duties of an estate executor

Elder Law

Medicaid planning is crucial to protect assets

Estate Planning

Handling digital assets after death

Special Needs Planning

About special needs trusts

Estate Planning

Why trusts may help to pass and shield assets

Estate Planning

Estate planning can protect beneficiaries from themselves

Estate Planning

Using TOD designations in an estate plan

Estate Planning

Decanting assets from irrevocable trusts

Estate Planning

Estate planning for every stage of life

Estate Planning

Hugh Hefner’s estate plan is a good model for others

Estate Planning

Reasons to have a trust in an estate plan

Estate Planning

The advantages of trusts over 529 plans

Estate Planning

Reasons to have a funeral trust

Elder Law

How retirees can pay for long-term care

Estate Planning

Qualified personal residence trusts and estate planning

Estate Planning

Reaching financial goals with an irrevocable trust

Elder Law

The importance of signing up for Medicare Part B promptly

Power of Attorney

The importance of updating a power of attorney

Estate Planning

Guardianships in Ohio

Estate Planning

Estate planning tips for those who remarry in Ohio

Estate Planning

Letter of final wishes in estate planning

Estate Planning

Possible estate tax reforms on the horizon

Estate Planning

Planning for retirement and long-term care

Estate Planning

Duties in estate administration

Estate Planning

How a charitable trust may be preserved

Estate Planning

Making the location of a will known

Estate Planning

Learning about trusts

Elder Law

Legal guidance regarding long-term care planning

Estate Planning

Points to remember in an estate plan

Probate

Using trusts to avoid probate

Estate Planning

Important things to keep in mind regarding estate planning

Estate Planning

How to properly settle an estate

Estate Planning

Planning now could prevent abuse by guardian in later years

Elder Law

Preparations for managing an elder’s assets and health

Estate Planning

Multiple deaths in a family could undermine an estate plan

Estate Planning

Record of account passwords essential for estate plans

Estate Planning

Estate planning errors made by celebrities

Estate Planning

Bequeathing assets unequally but fairly

Estate Planning

Including an ethical will in an estate plan

Estate Planning

Understanding “tenants in common”

Estate Planning

How trusts are handled when they come to an end

Estate Planning

Creating a will while still young

Estate Planning

Preparation of the estate for business owners

Power of Attorney

Use of a financial power of attorney in preparing for the future

Estate Planning

Beneficiary designations are different from bequests

Estate Planning

Estate planning for people with homes in two states

Estate Planning

Living trusts privately transfer property to heirs

Estate Planning

Estate planning is for everyone

Estate Planning

Smart estate planning tips

Estate Planning

How trusts can help Ohio residents with estate planning

Estate Planning

Artists may have specific estate planning needs

Estate Planning

Reasons to get a living trust in Ohio

Estate Planning

Educating family members about preserving wealth

Estate Planning

What a revocable trust does and doesn’t do

Power of Attorney

Handling parental assets without power of attorney

Estate Planning

The importance of valid signatures on a will

Estate Planning

Our attorneys can help you handle your Ohio estate plan

Estate Planning

Divorcing couples should consider their estate plans

Estate Planning

Managing a child’s inheritance

Estate Planning

Executors who fail in their duties can be replaced

Estate Planning

The importance of beneficiary designations

Estate Planning

Prince’s death and his estate

Estate Planning

The advantages of a living trust

Estate Planning

Importance of making a will in Ohio

Estate Planning

Estate planning essential for smooth distribution of property

Estate Planning

The role of the settlor in trust planning

Estate Planning

When an heir dies before receiving an inheritance

Estate Planning

Creating trusts for children in Ohio

Estate Planning

The benefits of an effective estate plan

Estate Planning

When people need to update their estate plan

Estate Planning

Avoiding mistakes with beneficiary designations

Estate Planning

The benefits of a living revocable trust

Estate Planning

David Bowie leaves behind lesson in estate planning

Elder Law

Options for Financing Long-Term Care

Estate Planning

Modernization of the irrevocable trust

Power of Attorney

The importance of a financial power of attorney

Elder Law

Checklist: Choosing an Assisted Living or Continuing Care Facility

Estate Planning

Estate planning for future health needs in Ohio

Elder Law

Medicaid Myths

Estate Planning

Totten trusts instead of a will

Estate Planning

Trusts for animals can provide for a pet’s future

Estate Planning

Placing limits on inheritances in Ohio

Estate Planning

Protecting wealth across generations

Elder Law

Q&A On VA Benefits and 2016 Changes To Aid and Attendance Regulations

Estate Planning

Potential problems with foreign wills

Estate Planning

Single people need wills just like parents do

Estate Planning

Why digital estate planning storage may not be a good idea

Estate Planning

Duties of an executor

Estate Planning

Trust funds and taxes

Estate Planning

Some estate planning considerations often overlooked

Estate Planning

When to choose a revocable trust over a will

Estate Planning

Changes in tax laws can lead to estate plan changes

Estate Planning

Trusts, wills and the cy pres doctrine

Estate Planning

Controlling beneficiary spending through trusts

Estate Planning

Why young adults in Ohio need an estate plan

Estate Planning

Trusts and estate planning

Estate Planning

Revising an estate plan based on new tax rules

Estate Planning

What are some of the major reasons to use a trust?

LGBTQ+ Issues

Estate planning for same-sex couples

Estate Planning

The importance of drafting a will

Estate Planning

How inheritances are becoming less common

Estate Planning

Estate planning and alternatives to wills

Estate Planning

Beneficiary designations and estate planning

Probate

The process of removing an ineffective executor

Estate Planning

The use of irrevocable trusts

Special Needs Planning

Benefits of funding a special needs trust through life insurance

Estate Planning

Planning for incapacity

Estate Planning

The importance of having a will

Estate Planning

Common estate planning issues in Ohio

Estate Planning

Options for long-term care planning

Estate Planning

The hidden cost of transferring wealth through a trust

Estate Planning

The importance of writing a will

Probate

Usefulness of living trusts extends beyond avoiding probate

Estate Planning

The estate administration process in Ohio

Estate Planning

Establishing NCP trusts to protect assets in Ohio

Power of Attorney

Learn more about power of attorney in Ohio

Estate Planning

The importance of establishing a living will

Estate Planning

How a QPRT can be useful to Ohio residents

Estate Planning

Financial requirements for Medicaid in Ohio

Estate Planning

Ohio legacy trusts

Estate Planning

The most common types of trusts

Estate Planning

What is a living will and do I need one?

Estate Planning

Challenging a will in Ohio

Estate Planning

Wills and beneficiary changes

Power of Attorney

How can someone become a guardian?

Estate Planning

Considering a living trust

Special Needs Planning

Creating an Ohio special needs trust

Estate Planning

Trustees subject to duties imposed by statute

Estate Planning

What documents do I need in an estate plan?

Estate Planning

The prenup v. estate plan conundrum can be solved

Estate Planning

Estate planning should not require a big reveal moment

Estate Planning

Estate planning, long-term care planning, or both?

Estate Planning

Sound estate planning encompasses wide-ranging concerns

Special Needs Planning

What is a special needs trust, and can it avail my family?

Estate Planning

Medicaid: Program’s complexity rewards advance legal planning

Elder Law

Cut Your Medical Bills

Probate

Should you avoid probate, and if so, how?

Estate Planning

Debunking Five Common Estate Planning Myths

Estate Planning

What is the biggest cost when you die?

Estate Planning

Don’t Let Medicaid Take Your Home!

Elder Law

Medicaid Coverage For Expensive Nursing Homes At Risk in OHIO–The Rest of the US Better Watch Out!